pay ohio unemployment taxes online

You may apply for a waiver of these assessments. Office of Unemployment Insurance.

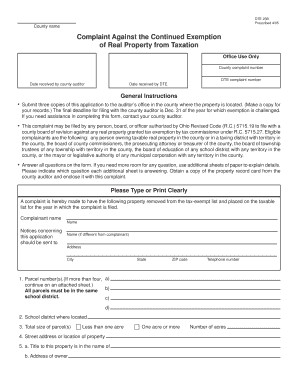

Ohio Unemployment Ein Number Fill Online Printable Fillable Blank Pdffiller

To qualify for unemployment you must.

. Mike DeWine Wednesday brought Ohio in line with federal tax law. If you are the account administrator for your. The state UI tax rate for new employers also known as the standard beginning tax rate can change from one year to the next.

On Employer Login page select and click Register to maintain TPA account online link. File Unemployment Taxes Online. On April 6 2021 the Department of Taxation issued the tax alert Ohio Income Tax Update.

For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text telephones TTYs or adaptive telephone equipment. What are the consequences of failing to file or pay unemployment insurance taxes. To submit your quarterly tax report online please visit httpsthesourcejfsohiogov.

1 CASCADE PLZ STE 100 AKRON OH 44308-1161. When you enter wage information the Gateway automatically calculates the taxable wages and contributions taxes due for you and provides payment options. Premium federal filing is 100 free with no upgrades for premium taxes.

Additional information about the Ohio Unemployment Tax can be obtained from our home page or by contacting the Division of Tax and Employer Service at 614 466-2319. It is available 24 hours a day 7. However its always possible the amount could change.

JFS-20106 Employers Representative Authorization for Taxes. 100 free federal filing for everyone. If you are remitting for both Ohio and school.

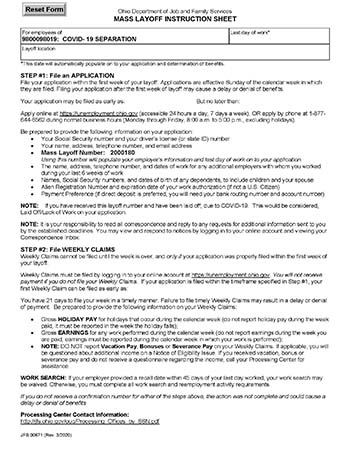

The Ohio Department of Job and Family Services Mike DeWine Governor Matt Damschroder ODJFS Director. File Unemployment Taxes Online. By calling 877 644-6562 or TTY 614 387-8408.

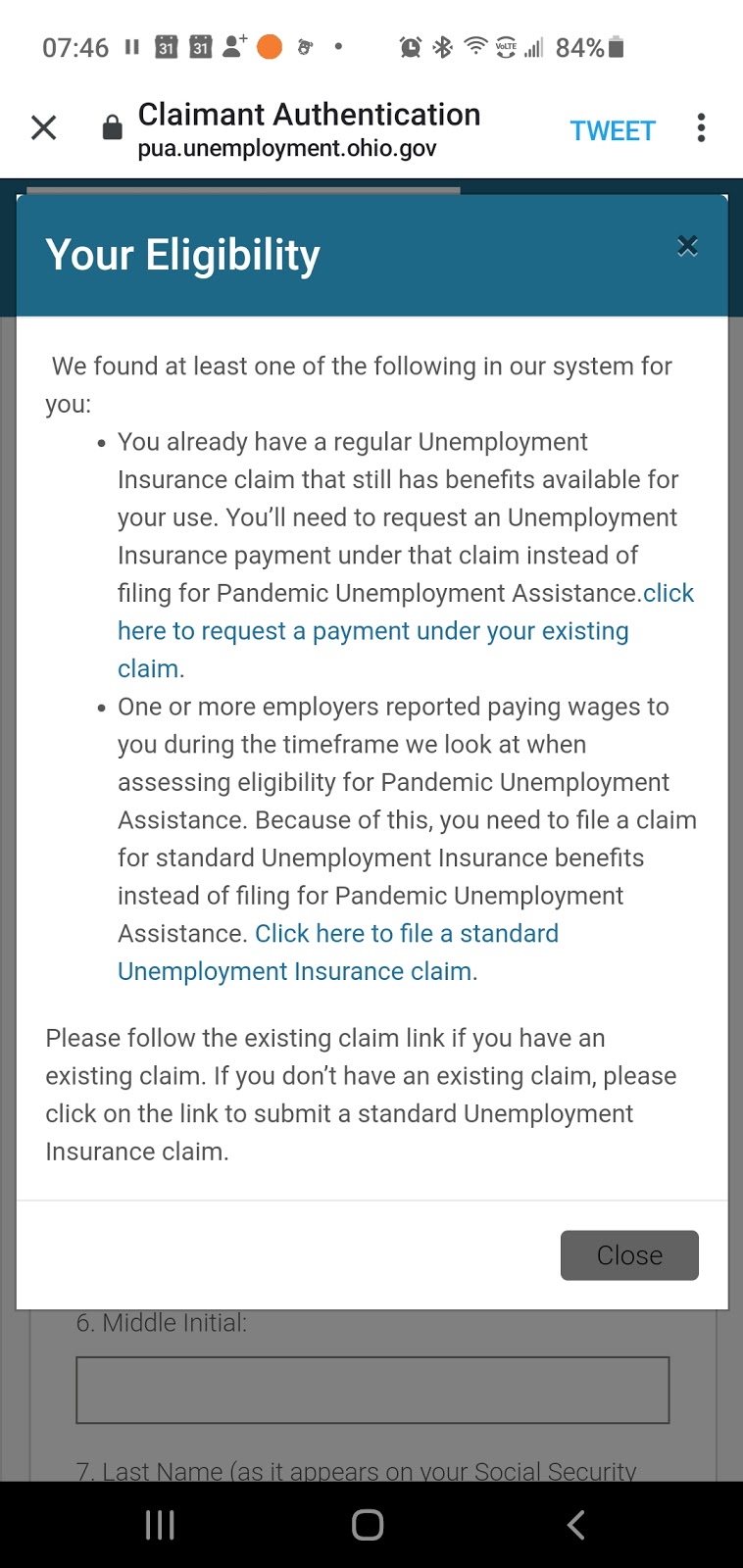

You will need to file a new claim if you have not applied for unemployment benefits at any time in the past 12 months. To register as the Employer Representative click on the Create a New Account button below. Employers who pay unemployment contributions.

Payments by Electronic Check or CreditDebit Card. Changes in how Unemployment Benefits are taxed for Tax Year 2020. In recent years however it has been stable at 27.

Several options are available for paying your Ohio andor school district income tax. Used by employers to authorize someone other than the employer to provide. Once you have registered and received a User Name and Password click the Log-On to Existing Account button.

The Ohio Business Gateway is another option available to submit current quarter unemployment reports and payments. Once the missing Quarterly Tax Return is processed you will be assessed penalty and interest. Up to 25 cash back That amount known as the taxable wage base has been stable at 9000 in Ohio since the year 2000.

Apply for Unemployment Now Employee 1099 Employee Employer. Should you have any questions please call the contribution section at 614-466-2319. JFS-20125 UC Quarterly Tax Return.

The online initial application takes about 25 minutes. Box 182059 Columbus Ohio 43218-2059 If you have any questions or concerns about making a repayment please call 877-644-6562 option. Or you can file for unemployment benefits by phone Monday through Friday except holidays from 8 am.

If your small business has employees working in Ohio youll need to pay Ohio unemployment insurance UI tax. The online registration process can take 1-2 days. An employers filing frequency for state income tax withholding is determined each calendar year by the combined amount of state and school district taxes that were withheld or required to be withheld during the 12-month period ending June 30 of the preceding calendar year ie total state and school district income tax withheld for 7119.

As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020. If you need your 2020 Tax form prepared for you. The Gateway populates previously reported employees and wage data.

Ad File your unemployment tax return free. Ohio Department of Job and Family Services PO. Paper Form Exception Filing Information In Ohio employers are required to submit their Quarterly Tax Return.

True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19. Your application is not filed until you receive a confirmation number. If you are disconnected use your username and PIN to log back on and resume the application process.

This tax alert provided guidance related to the federal deduction for certain unemployment benefits. Used by employers to submit quarterly wage detail and unemployment taxes. To file and pay online you can use either the ERIC system or the Ohio Business Gateway.

Online Services is a free secure electronic portal where you can file and pay your Ohio individual and school district income taxesYou can also review notices and information about those taxes from the Department. Report it by calling toll-free. For more information see page 5 of the Workers Guide to Unemployment.

Payments made online may not immediately.

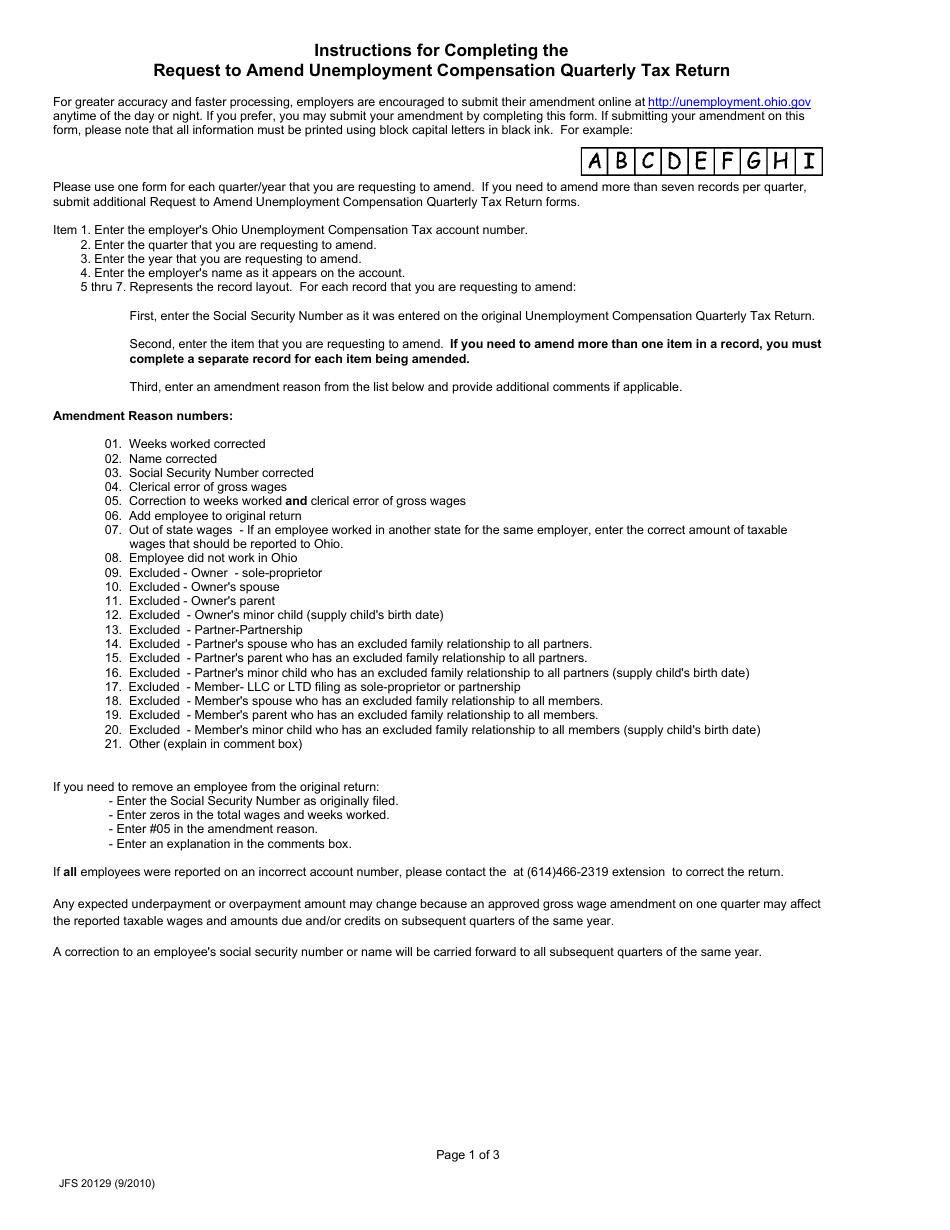

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

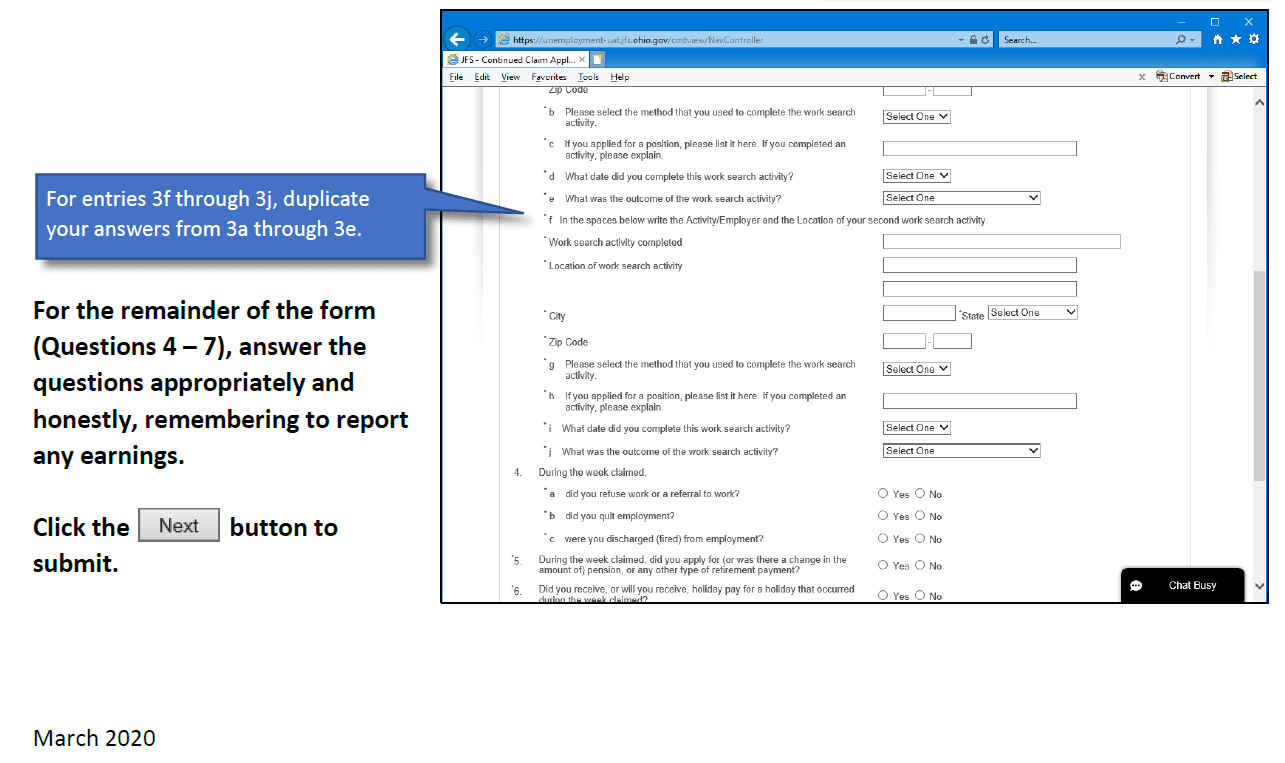

Filing For Your Weekly Unemployment Benefits In Ohio Youtube

Unemployment Insurance Ohio Gov Official Website Of The State Of Ohio

Ohio Department Of Job And Family Services Filing For Your Weekly Unemployment Benefits Youtube

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Ohio Unemployment Phone Number Ohio Unemployment Customer Service Number Pua Ohio Unemployment Login

Ohio Targets Fraud As 1099 G Tax Form Distribution Begins Business Journal Daily The Youngstown Publishing Company

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

Covid 19 Unemployment Benefits Hamilton Ryker

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Some People Not Receiving Unemployment 1099 G Tax Forms

Labor Employment Alert Guidance On Ohio Unemployment Compensation Brouse Mcdowell Ohio Law Firm

Ohio Waivers Now Available For Pandemic Unemployment Overpayments Cleveland Com

Tens Of Thousands Of Ohioans Told To Repay Unemployment Benefits Woub Public Media